GambleFi Portfolio | Increaing Dividends

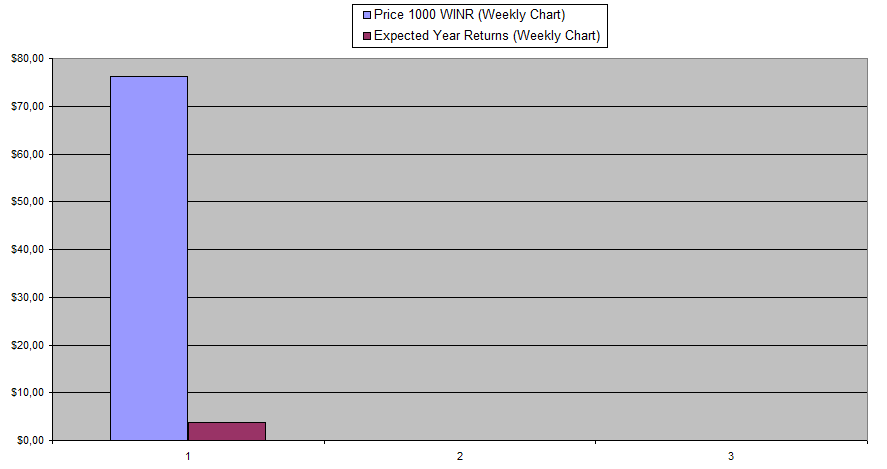

WINR Protocol

I'm still getting some basic stats on WINR and based on what I'm tracking in this first week for having staked vWINR the APY is just 4.9% which is in line with other decentralized projects like SX.Bet. This means that the valuation of the coin is mostly based on growth anticipation.

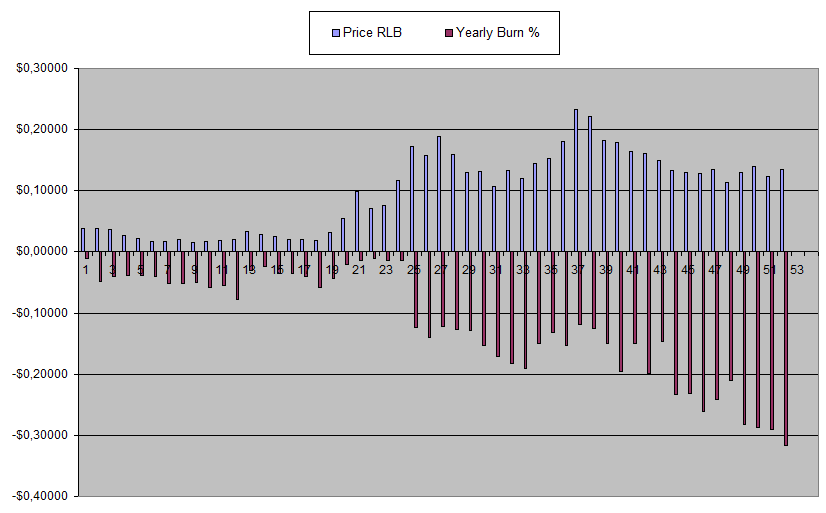

Also for this project I'm making a chart for with a bar for the Price of 1000 WINR along with what the yearly return is expected to be next to it on a weelky basis which for me is the best possible visualisation for someone who is looking the actually earn from a platform by holding tokens.

Price seems to be dipping more and even though I'm tempted to buy more, I also have a hard time to see WINR ending up as an actuall winner in this GambleFi Space. Mostly because I have no real urge to use the actual platform at the moment. Once their sports betting app is released I will see how that one holds up.

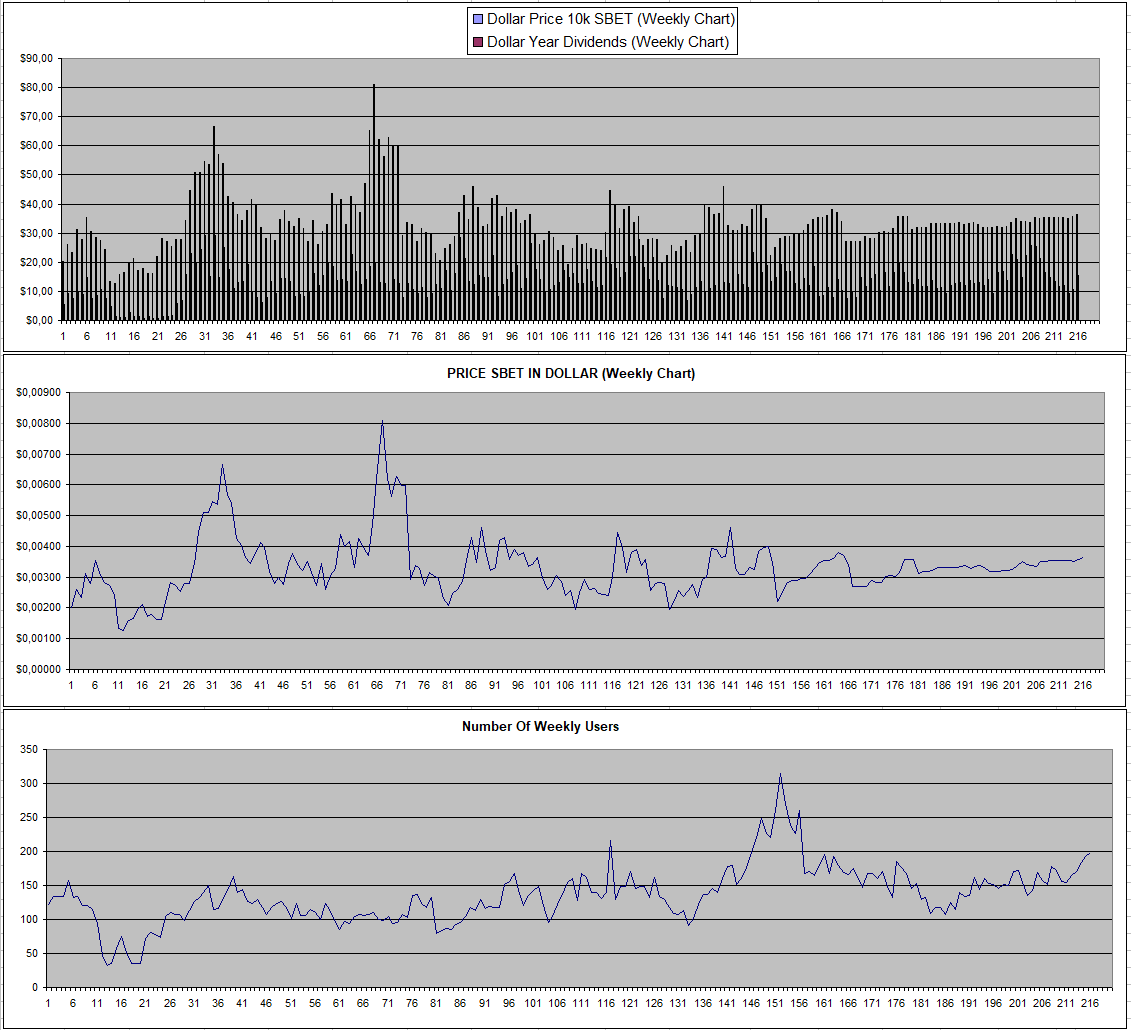

Sportbet.one (SBET)

There seems to be some slow growth of SBET mostly with an increase in weekly users reaching above 200 again. The price also slightly increased along with a couple new SBET Holders and an increase in Dividends. Still no no means anything spectacular but I would sign after multiple years for this slow uptrend to continue as it's hard to see a crazy pump.

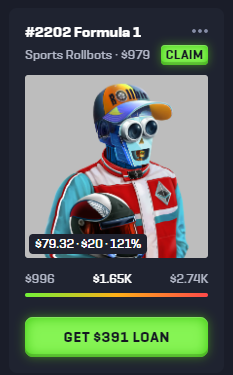

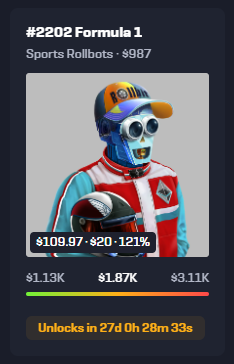

Rollbit.com (RLB) & Rollbot/Sportsbot NFTs

The profit share on Sportsbots continues to increase in value at a rapid pace as the Whale continues his gambling Spree. Last week it was at 109.97$ just in 7 days it went to 151.29$! Knowing I only paid 440$ or so for it, this has been a big winner I never saw coming otherwise I would have bought way more. The price of the NFTs is also going up and at a minimum suggested 1380$ for my NFT, the expected profit claim over the course of a year is 1923$. The tricky thing however is that it all can come down again as the revenue mostly comes from 1 big whale.

| Previous Lock | Current Lock | Last Week | Now |

|---|---|---|---|

|  |  |  |

The lottery was also won this week (400k+) so it started to rebuild again and the token is seeing some signs of life as the burn is so high that the price just needs to go up or at least has great support on the downside.

The burn also continues to smash new records and it's now at over 30% of the supply over a year at this pace. I continue to hold my RLB Bag for now.

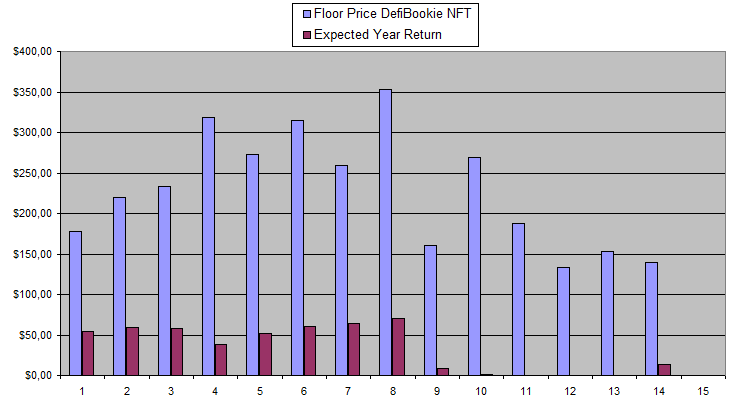

NFT values continue to go up along with the dividends as I now fully calculated the increased sports bot into the numbers.

So overall things are and look great for RLB and I'm glad it's part of my holdings in this portfolio.

Defibookie (NFTs)

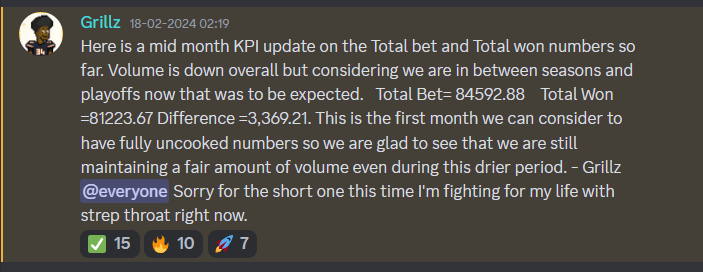

There was an update on the discord about the expected revenue halfway through the month and it looks like the volumes are down despite the superbowl. It also reflects in the NFT prices which are down close to what the mint price was in dollar value. Purely based on the overall valuation <300k, I'm tempted to buy more but at the same time I have a hard time to see DefiBookie as more than just a smaller "gimmick project" that will have some users but overall will fall short unless there are some major improvements.

The good thing is that there is still a revenue share that despite low earnings for the site is at 13.93% APY.

| Week | Invested | Floor | Current Value | Week Divs | Total Divs | Recovered | Total |

|---|---|---|---|---|---|---|---|

| Week 01 | 1424$ | 180$ | 2340$ | 0$ | 0$ | 0.00% | +916$ |

| Week 02 | 1424$ | 156$ | 1927$ | 0$ | 0$ | 0.00% | +503$ |

| Week 03 | 1424$ | 177$ | 2191$ | 13.67$ | 13.67$ | 0.96% | +780$ |

| Week 04 | 1421$ | 219$ | 2708$ | 14.92$ | 28.59$ | 2.01% | +1315$ |

| Week 05 | 1421$ | 233$ | 2875$ | 14.49$ | 43.08$ | 3.03% | +1497$ |

| Week 06 | 1421$ | 318$ | 3932$ | 9.444$ | 52.52$ | 3.69% | +2563$ |

| Week 07 | 1421$ | 273$ | 3374$ | 12.95$ | 65.72$ | 4.62% | +2016$ |

| Week 08 | 1421$ | 315$ | 3894$ | 15.24$ | 80.97$ | 5.70% | +2554$ |

| Week 09 | 1421$ | 259$ | 3199$ | 15.97$ | 96.94$ | 6.82% | +1875$ |

| Week 10 | 1421$ | 353$ | 4365$ | 17.67$ | 114.61$ | 8.06% | +3058$ |

| Week 11 | 1421$ | 161$ | 1988$ | 2.13$ | 116.74$ | 8.22% | +684$ |

| Week 12 | 1421$ | 269$ | 3325$ | 0.332$ | 117.07$ | 8.23% | +2021$ |

| Week 13 | 1421$ | 187$ | 2314$ | 0.092$ | 117.16$ | 8.23% | +1010$ |

| Week 14 | 1421$ | 133$ | 1640$ | 0.000$ | 117.16$ | 8.23% | +336$ |

| Week 15 | 1421$ | 153$ | 1885$ | 0.000$ | 117.16$ | 8.23% | +581$ |

| Week 16 | 1421$ | 140$ | 1728$ | 3.310$ | 120.47$ | 8.47% | +427$ |

| Week 17 | 1421$ | 127$ | 1564$ | 4.410$ | 124.88$ | 8.78% | +268$ |

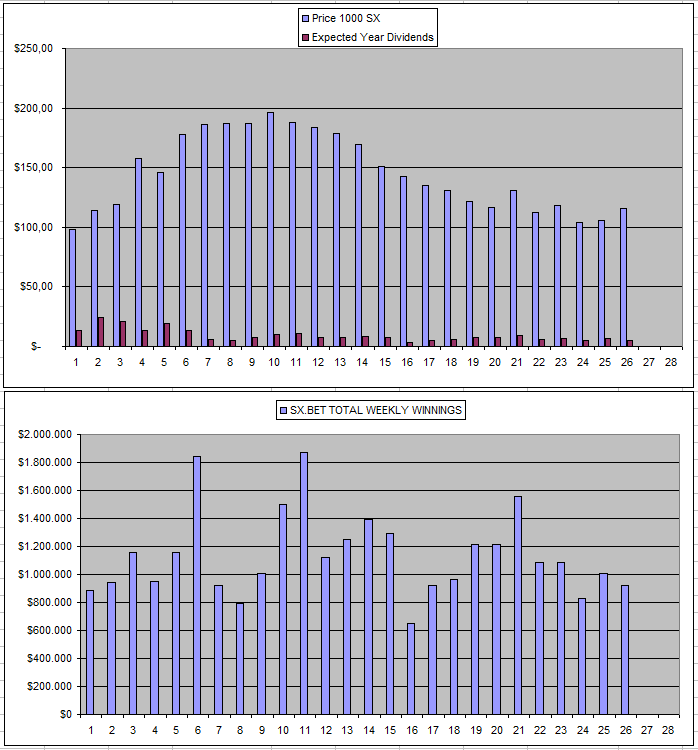

Sx.Bet (SX)

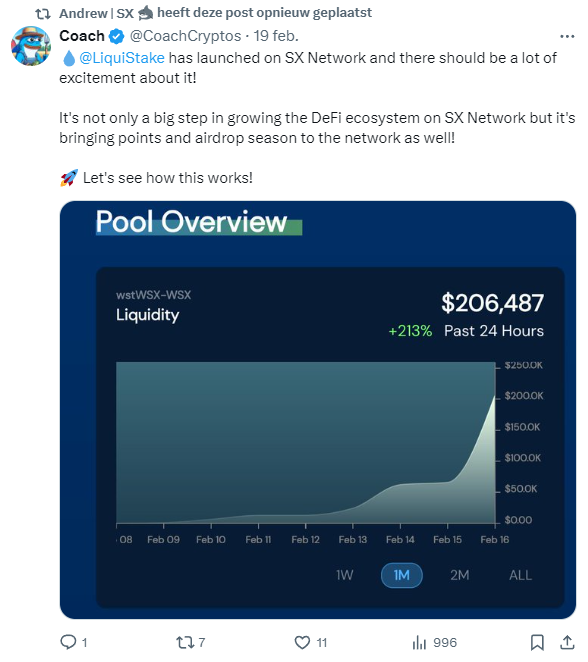

There was some development on SX with Liquid Staking going live and I still need to have a closer took at it to actually make full sense of it.

Overall the returns and total weekly winnings continue to be on the lower end without much progress. That is the main thing I'm looking at.

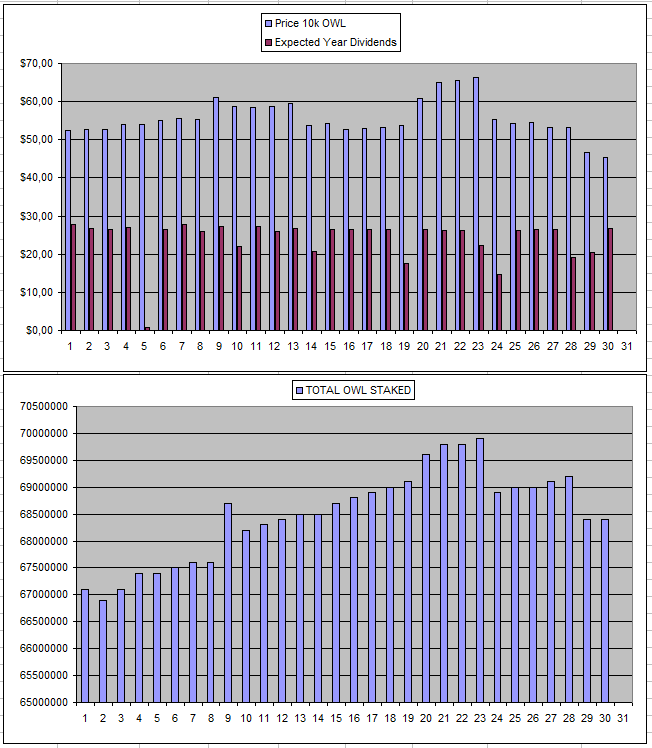

Owl.Games (OWL)

Owl seems to be back at the normal expected earnings which range around 30$ for 600k Owl staked. Just based on the returns I'm tempted to buy more but there are just way too many things about this projects that are unclear or even feel dodgy so I just stick with what I have and continue to earn back the original investment that I put in with the hope that it somehow takes off at one point even though I'm not counting on it.

| Date | Hold | Invested | Value | Week Divs | Total | % recov | Total |

|---|---|---|---|---|---|---|---|

| 08/08/2023 | 395k | 1954$ | 1850$ | 13.76$ | 21.9$ | 1.12% | -82$ |

| 15/08/2023 | 400k | 2084$ | 1867$ | 20.40$ | 42.3$ | 2.03% | -171$ |

| 22/08/2023 | 400k | 2084$ | 1911$ | 20.80$ | 63.1$ | 3.03% | -106$ |

| 29/08/2023 | 400k | 2084$ | 1950$ | 0.55$ | 63.6$ | 3.05% | -67$ |

| 05/09/2023 | 500k | 2636$ | 2437$ | 20.30$ | 83.9$ | 3.18% | -115$ |

| 12/09/2023 | 500k | 2636$ | 2454$ | 26.77$ | 110.67$ | 4.20% | -71$ |

| 19/09/2023 | 500k | 2636$ | 2449$ | 25.00$ | 135.67$ | 5.15% | -51$ |

| 26/29/2023 | 500k | 2636$ | 2699$ | 26.17$ | 161.84$ | 6.14% | +225$ |

| 03/10/2023 | 500k | 2636$ | 2600$ | 21.15$ | 182.99$ | 6.94% | +147$ |

| 10/10/2023 | 500k | 2636$ | 2582$ | 26.1$ | 209.09$ | 7.96% | +155$ |

| 17/10/2023 | 500k | 2636$ | 2590$ | 25.05$ | 234.14$ | 8.88% | +188$ |

| 24/10/2023 | 500k | 2636$ | 2624$ | 25.62$ | 259.76$ | 9.85% | +248$ |

| 31/10/2023 | 600k | 3179$ | 2947$ | 19.95$ | 279.71$ | 8.80% | +48$ |

| 07/11/2023 | 600k | 3179$ | 2877$ | 30.43$ | 310.14$ | 9.75% | +8$ |

| 14/11/2023 | 600k | 3179$ | 2796$ | 30.55$ | 340.69$ | 10.72% | -42 |

| 21/11/2023 | 600k | 3179$ | 2813$ | 30.65$ | 371.34$ | 11.68% | +5$ |

| 28/11/2023 | 600k | 3179$ | 2824$ | 30.53$ | 401.87$ | 12.64% | +47$ |

| 05/12/2023 | 600k | 3179$ | 2851$ | 20.12$ | 421.99$ | 13.27% | +94$ |

| 12/12/2023 | 600k | 3179$ | 3221$ | 30.42$ | 452.46$ | 14.23% | +494$ |

| 19/12/2023 | 600k | 3179$ | 3445$ | 30.14$ | 482.60$ | 15.18% | +749$ |

| 26/12/2023 | 600k | 3179$ | 3475$ | 30.40$ | 513.00$ | 16.14% | +809$ |

| 01/01/2024 | 600k | 3179$ | 3521$ | 25.76$ | 538.76$ | 16.95% | +881$ |

| 08/01/2023 | 600k | 3179$ | 2933$ | 17.00$ | 555.76$ | 17.48% | +310$ |

| 15/01/2024 | 600k | 3179$ | 2879$ | 30.35$ | 586.11$ | 18.43% | +286$ |

| 23/01/2024 | 600k | 3179$ | 2888$ | 30.45$ | 616.56$ | 19.39% | +325$ |

| 30/01/2024 | 600k | 3179$ | 2825$ | 30.45$ | 647.01$ | 20.35% | +293$ |

| 06/02/2024 | 600k | 3179$ | 2825$ | 22.16$ | 669.17$ | 21.05% | +315$ |

| 13/02/2024 | 600k | 3179$ | 2469$ | 23.57$ | 692.74$ | 21.80% | -17$ |

| 20/02/2024 | 600k | 3179$ | 2407$ | 30.74$ | 723.48$ | 22.76% | -48$ |

** the High 7% cost to go from buying to having it staked and the 5% tax to sell is fully included in the numbers.

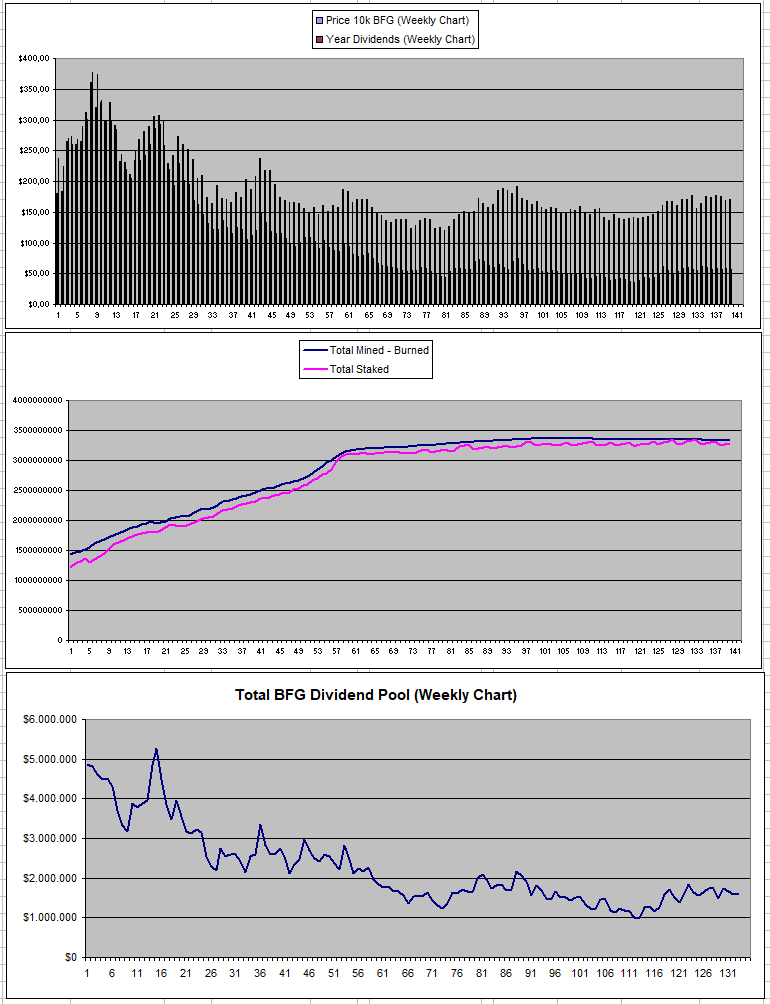

Betfury.io (BFG)

There is a proposal this week to create stBFG which is BFG that gets staked and locked for at least a year which would give double the APR% making it so that the Liquid BFG on the market gets reduced so it's harder for BFG to be dumped by holders in case there is a price pump. Basically, it means that those who don't opt to stake their BFG will earn less and nothing more. It will be possible to do an emergency unlock at a cost that I assume will get burned.

For me, this update doesn't really bring anything extra and is just an attempt to make it easier to pump the price. I voted for no changes as I want to leave an option open to take profit in case there would be a pump without having to do an emergency unlock giving part of the profit away. If you are in it for the dividends you are pretty much obligated to lock for a year. I'm also not really that opposed to the idea and it looks lik it will easily win currently at 75% who are for.

The core numbers for me is what it is more about and those remain stable

APY Based on Current Price and Dividends from the last 7 days

All these numbers are based on prices of Monday

| Project | APY |

|---|---|

| Sportbet.one (SBET) | +42.69% APY |

| Betfury.io (BFG) | +33.23% APY |

| Rollbit.com (NFTs) | +72.68% APY* |

| Owl.Games (OWL) | +58.67% APY |

| Sx.Bet (SX) | +4.05% APY |

| Defibookie.io (NFTs) | +13.93% APY |

| WINR Protocol (WINR) | +4.90% APY |

Note: Token prices going up or down have a major influence on the actual returns going forward either amplifying them if they go up or destroying them when the price would dip. These are my personal numbers and RLB varies based on the trait of the Rollbot NFTs you own and (*) they are based on the minimum suggested by prices which can be way lower than the actual prices.

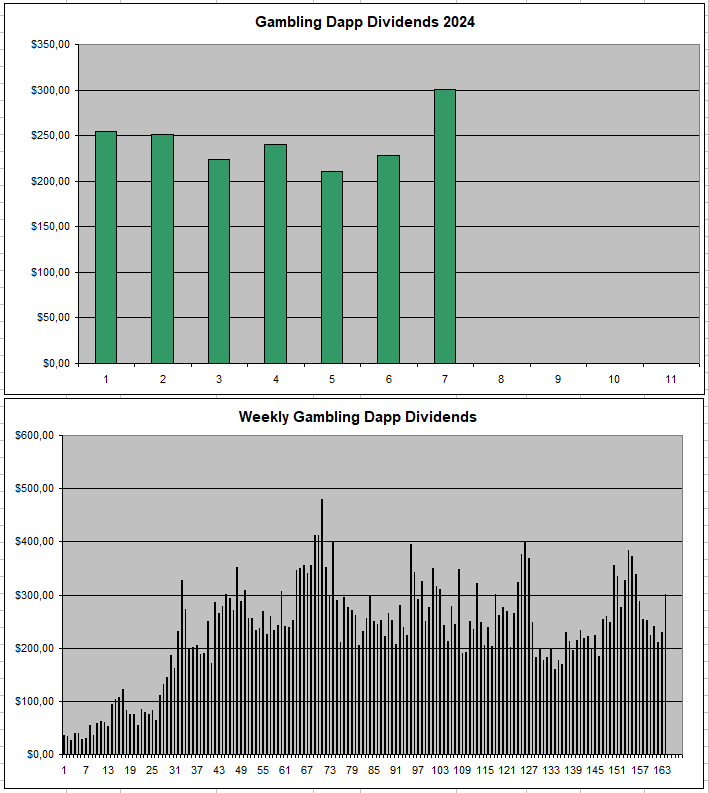

Personal Gambling Dapp Portfolio

I got what I hoped for last week which was 300$+ in passive earnings for holding 5M SBET | 500k BFG | 3 Rollbot NFTs | 600k OWL | 25k SX | 13 DefiBookie NFTs | 10k WINR. I'm still looking to diversify with other good gambling dapps that pay the losses or fees from the gambler to those holding a token. Anyone that has tips on this, please leave a comment below...

Crypto & Blockchain-Based Bookies and Exchanges that I'm personally using with some allowing anonymous betting with no KYC or personal restrictions...

|  |  |

|---|---|---|

|  |  |

|  |  |

Play2Earn Games that I am Playing...

|  |  |

|---|