GambleFi Portfolio | Year in Review!

Another Year has been completed with my GambleFi portfolio and this one was mostly marked by doing some diversification in a more risky project (Openbet) getting a bit too greedy which backfired taking away a lot of my earnings. It was a risk I was aware of but underestimated but at the same time, I needed to rebalance as too much of my funds were in SBET which would have been a way bigger disaster in case that would have gone down. I still did end with an overall profit and I'm in a good spot to keep earning passive dividends in 2024 going forward being diversified over 6 different platforms and I'm still lookig to possibly adding some more to it.

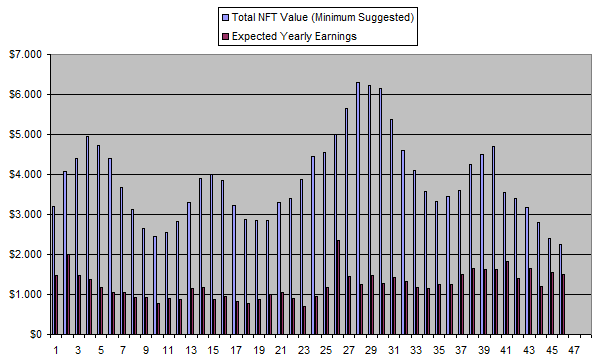

Sportbet.one (SBET)

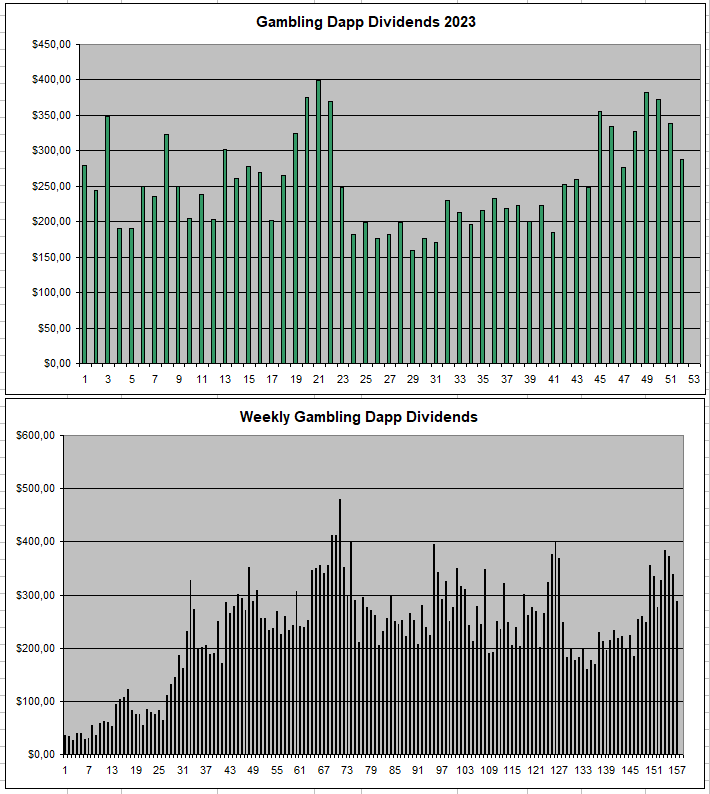

SBET continued to be the project that brings in most of the earnings by far while staying relatively stable. The price at the start of the year was 0.00311$ and now is sitting at 0.00354$. I didn't have any issue whatsoever with them both on the investing and betting side of things but overall growth is kind on non-existent and I'm kind of giving up hope that things will really explode. At the same time, the returns are good enough to just keep holding what I have even though it likely will underperform in the bull market. The fact that I'm getting somewhere between 120$-250$ from it weekly is quite big though.

Rollbit.com (RLB) & Rollbot/Sportsbot NFTs

I was lucky to find Rollbit quite early but didn't benefit as much from the crazy rise in price as most of my investment was in the NFTs. At the current price based on the burn, RLB still feels cheap and it has gotten to a point where my gambling balance and some more is fully in RLB waiting for a point where the burn goes below 12.5% on a yearly basis.

At the moment it's at 20%+ of the supply which will get burned yearly based on the current revenue and RLB Price.

So overall, things look pretty good for Rollbit going into 2024

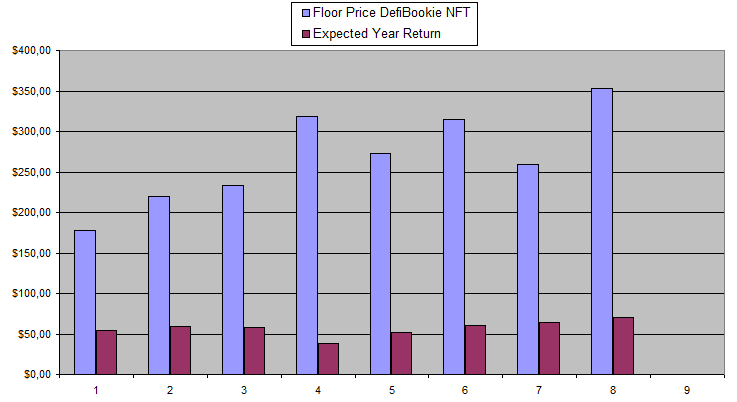

Defibookie (NFTs)

I have done a great deal getting 13 Mints of the DefiBookie NFTs paying 1423$ for it as they are now worth 4365$ with a return that is currently at 64.55% APY based on ly entry price.

There hasn't been any info get on the December revenue but it looks like they added quite some bonk to the token pool.

| Week | Invested | Floor | Current Value | Week Divs | Total Divs | Recovered | Total |

|---|---|---|---|---|---|---|---|

| Week 01 | 1424$ | 180$ | 2340$ | 0$ | 0$ | 0.00% | +916$ |

| Week 02 | 1424$ | 156$ | 1927$ | 0$ | 0$ | 0.00% | +503$ |

| Week 03 | 1424$ | 177$ | 2191$ | 13.67$ | 13.67$ | 0.96% | +780$ |

| Week 04 | 1421$ | 219$ | 2708$ | 14.92$ | 28.59$ | 2.01% | +1315$ |

| Week 05 | 1421$ | 233$ | 2875$ | 14.49$ | 43.08$ | 3.03% | +1497$ |

| Week 06 | 1421$ | 318$ | 3932$ | 9.444$ | 52.52$ | 3.69% | +2563$ |

| Week 07 | 1421$ | 273$ | 3374$ | 12.95$ | 65.72$ | 4.62% | +2016$ |

| Week 08 | 1421$ | 315$ | 3894$ | 15.24$ | 80.97$ | 5.70% | +2554$ |

| Week 09 | 1421$ | 259$ | 3199$ | 15.97$ | 96.94$ | 6.82% | +1875$ |

| Week 10 | 1421$ | 353$ | 4365$ | 17.67$ | 114.61$ | 8.06% | +3058$ |

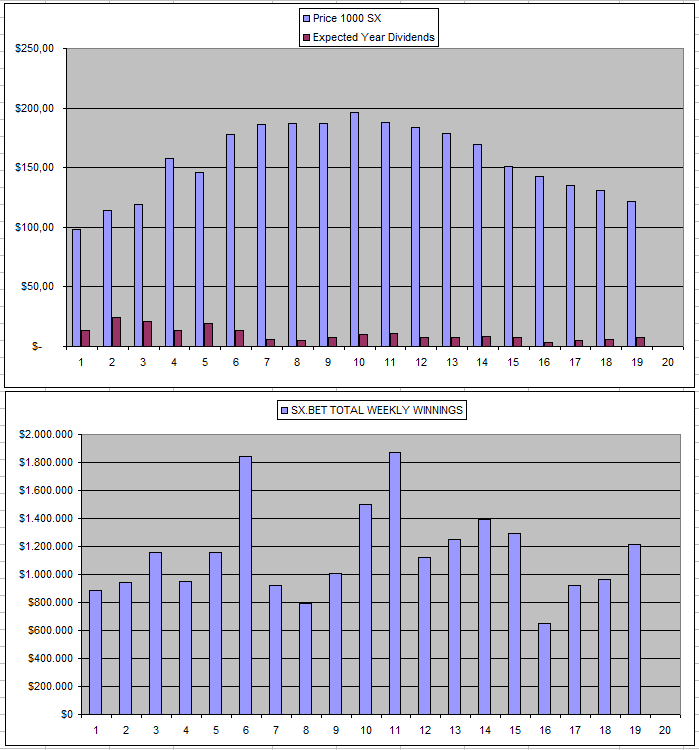

Sx.Bet (SX)

SX remains the project that I expect a lot from since it's the most decentralized, this also shows in the valuation of the token which is way higher compared to others which makes the returns a lot lower.

As always in Crypto, project with real products and revenue tend to have it much harder and SX still has to get a lot of adoption going forward but they should be in a good position to do so.

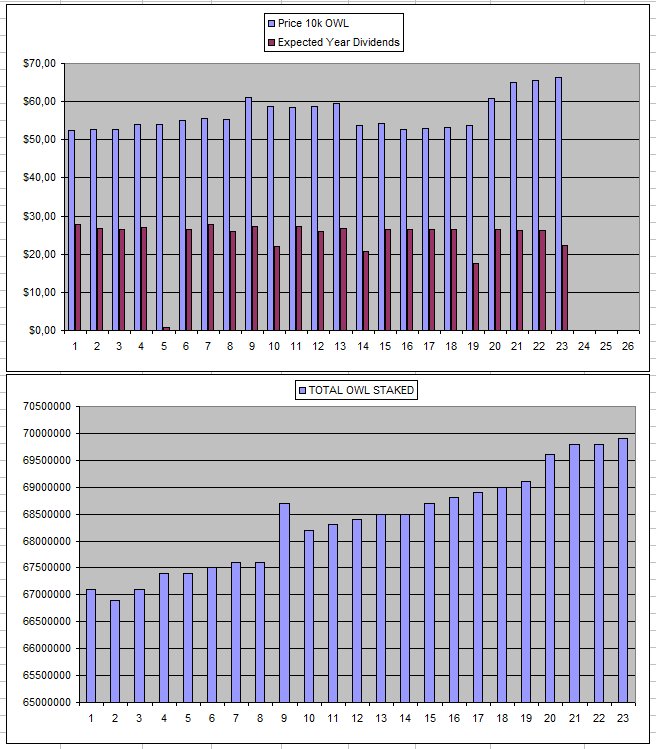

Owl.Games (OWL)

I had a minor issue with a withdraw that didn't come through as I used the Solana Network which apparently didn't go as I never used the withdraw address to do a deposit. It eventually did get resolved though. The price slowly continues to creep up but there is nothing crazy yet going on. The returns continue to be high but the level of centralization an unclearness is also quite big in this one. I did get banned at the start of their discord for asking about a delisting and it still is very unclear how the dividends actually represent a revenue share as they are always the same amount so far. All this not to speak about the very high costs in order to buy / stake / unstake / sell the actual tokens which all keeps me back from investing more.

I am currently in the green in case I would sell including all the costs that come with it and earned back around 17% of my original investment already after 22 weeks.

| Date | Hold | Invested | Value | Week Divs | Total | % recov | Total |

|---|---|---|---|---|---|---|---|

| 08/08/2023 | 395k | 1954$ | 1850$ | 13.76$ | 21.9$ | 1.12% | -82.1$ |

| 15/08/2023 | 400k | 2084$ | 1867$ | 20.40$ | 42.3$ | 2.03% | -171.1$ |

| 22/08/2023 | 400k | 2084$ | 1911$ | 20.80$ | 63.1$ | 3.03% | -106.3$ |

| 29/08/2023 | 400k | 2084$ | 1950$ | 0.55$ | 63.6$ | 3.05% | -66.7$ |

| 05/09/2023 | 500k | 2636$ | 2437$ | 20.30$ | 83.9$ | 3.18% | -115.1$ |

| 12/09/2023 | 500k | 2636$ | 2454$ | 26.77$ | 110.67$ | 4.20% | -71.33$ |

| 19/09/2023 | 500k | 2636$ | 2449$ | 25.00$ | 135.67$ | 5.15% | -51.33$ |

| 26/29/2023 | 500k | 2636$ | 2699$ | 26.17$ | 161.84$ | 6.14% | +224.84$ |

| 03/10/2023 | 500k | 2636$ | 2600$ | 21.15$ | 182.99$ | 6.94% | +146.99$ |

| 10/10/2023 | 500k | 2636$ | 2582$ | 26.1$ | 209.09$ | 7.96% | +155.09$ |

| 17/10/2023 | 500k | 2636$ | 2590$ | 25.05$ | 234.14$ | 8.88% | +188.14$ |

| 24/10/2023 | 500k | 2636$ | 2624$ | 25.62$ | 259.76$ | 9.85% | +247.76$ |

| 31/10/2023 | 600k | 3179$ | 2947$ | 19.95$ | 279.71$ | 8.80% | +47.71$ |

| 07/11/2023 | 600k | 3179$ | 2877$ | 30.43$ | 310.14$ | 9.75% | +8.14$ |

| 14/11/2023 | 600k | 3179$ | 2796$ | 30.55$ | 340.69$ | 10.72% | -42.31$ |

| 21/11/2023 | 600k | 3179$ | 2813$ | 30.65$ | 371.34$ | 11.68% | +5.34$ |

| 28/11/2023 | 600k | 3179$ | 2824$ | 30.53$ | 401.87$ | 12.64% | +46.87$ |

| 05/12/2023 | 600k | 3179$ | 2851$ | 20.12$ | 421.99$ | 13.27% | +93.99$ |

| 12/12/2023 | 600k | 3179$ | 3221$ | 30.42$ | 452.46$ | 14.23% | +494.46$ |

| 19/12/2023 | 600k | 3179$ | 3445$ | 30.14$ | 482.60$ | 15.18% | +748.60$ |

| 26/12/2023 | 600k | 3179$ | 3475$ | 30.40$ | 513.00$ | 16.14% | +809.00$ |

| 01/01/2024 | 600k | 3179$ | 3521$ | 25.76$ | 538.76$ | 16.95% | +880.796$ |

** the High 7% cost to go from buying to having it staked and the 5% tax to sell is fully included in the numbers.

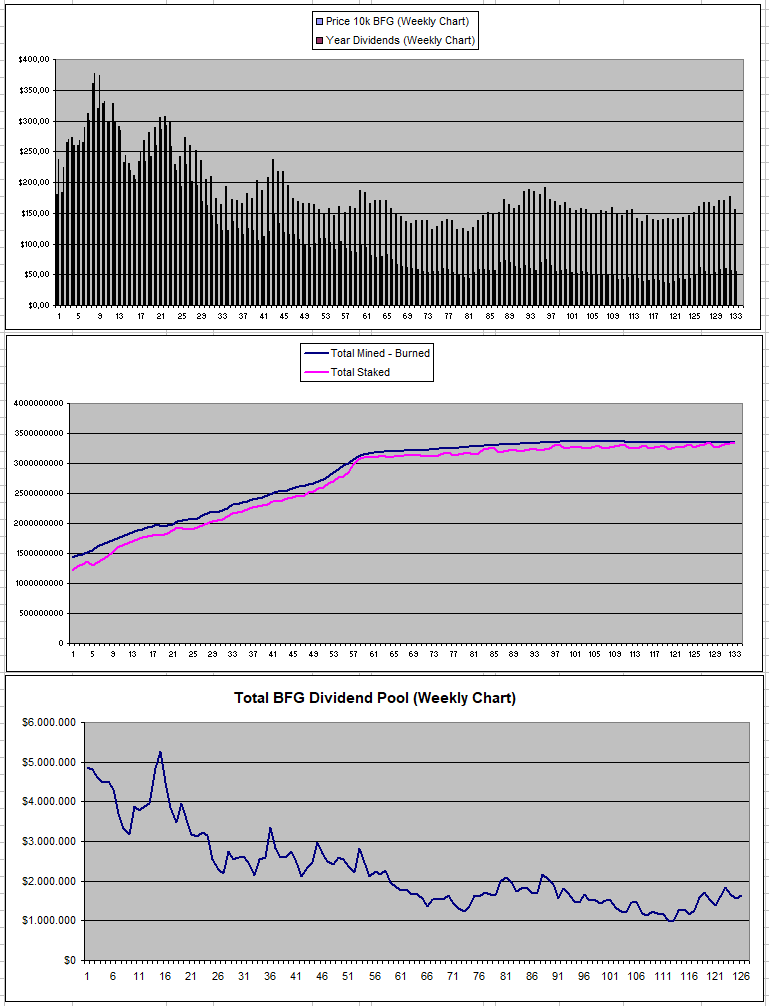

Betfury.io (BFG)

Betfury had some issues with their domain which caused some worry and a fall in the price but it looks like it all got fixed by now. Things continue to be quite stable with still some development going on and new things being introduced.

APY Based on Current Price and Dividends from the last 7 days

All these numbers are based on prices of Monday

| Project | APY |

|---|---|

| Sportbet.one (SBET) | +46.8% APY |

| Betfury.io (BFG) | +34.77% APY |

| Rollbit.com (NFTs) | +66.76% APY |

| Owl.Games (OWL) | +33.61% APY |

| Sx.Bet (SX) | +6.23% APY |

| Defibookie.io (NFTs) | +19.99% APY |

Note: Token prices going up or down have a major influence on the actual returns going forward either amplifying them if they go up or destroying them when the price would dip. These are my personal numbers and RLB varies based on the trait of the Rollbot NFTs you own and they are based on the minimum suggested by prices which can be way lower than the actual prices.

Personal Gambling Dapp Portfolio

In the last 2 weeks I managed to earn a total of 625$ for holding 5M SBET | 500k BFG | ~3500$ worth of Rollbot NFTs | 600k OWL | 25k SX | 4365$ worth of DefiBookie NFTs. I'm still looking to diversify with other good gambling dapps that pay the losses or fees from the gambler to those holding a token. Anyone that has tips on this, please leave a comment below...

Crypto & Blockchain-Based Bookies and Exchanges that I'm personally using with some allowing anonymous betting with no KYC or personal restrictions...

|  |  |

|---|---|---|

|  |  |

|  |  |

Play2Earn Games that I am Playing...

|  |  |

|---|

Gambling is a huge industry, not that Im into gambling to crypto offers great opportunity to invest on this platforms and be part of the gains, not that Im into gambling but definitely way different than irl casinos, may be if Hive was seen like a blockchain where you can develop on top we might have more platforms like the ones you mention, I think its time Hive is stop seen just as a social network blogging platform, VSC project could be part of the solution that we Hive could attract more users, is Owl.Games the one you hold for the longest time? still 17% after 22 weeks cool dividends for a down market 🤑

SBET has been the one I have been holding the longest for 210+ weeks now which kickstarted this portfolio which grew into somewhat an addiction to get more passive income. Sbet has been quite good to me as the only token that really held up fully during the bear market.