BiFi: DeFi With Bitcoin (Multi-Chain Keynote)

Updating blockchain-based protocols remain a significant challenge until the community is able to reach a consensus about the protocol or program, a hard-fork of such protocol may occur which cause splitting the blockchain's community.

Since 2017 after the crash of ICO, decentralized finance has increased and the boom was evident in 2020 and at the DeFi total value locked in USD is presently at 26.57B according to a platform that analyses and rank DeFi protocol (DeFiPulse).

Yes, Bitcoin was known to be the first DeFi as CEO of MyEtherWallet revealed sometime in 2020 but again, Ethereum gave the finance which Bitcoin gave the money.

%20Copy%20of%20Green%20and%20Black%20Modern%20Sales%20Marketing%20Presentation%20(10).png)

Problem With Ethereum Blockchain

A crypto beginner even if you are 6-months old, get an understanding of high gas fee attached to ethereum transactions. It is a piece of notable information that everyone in crypto space has been talking about which is a scalability problem.

Scalability problem ethereum blockchain occurred due to size and also the numbers of transactions per second, which thereby resulted in the high gas fee before a transaction can be confirmed.

DApps developers looked into major problems with blockchain-based protocol and come up with different solutions but all pointing towards the term INTEROPERABILITY. In simple term, the ability for a protocol to connect with multi-chain.

The Birth of BiFi

Late 2020, Bifrost team reached a consensus to launched BiFi with a focus on supporting transactions among cryptocurrencies from difference blockchain protocol, including Bitcoin since most DeFi services are limited to Ethereum ecosystem.

Have you come across DeFi with Bitcoin?

BiFi being the multichain DeFi platform powered by Bifrost supports borrowing and lending, and yield farming. The features of BiFi support a wider range of DeFi products along with its own multichain wallet, Bifrost Wallet, that supports assets beyond ERC-20.

Many of us invested in Bitcoin but majorly on a centralized exchange or rather pegged on something. BiFi becomes the first decentralized financial service to support the real Bitcoin, which means you can check the publish transaction on the blockchain.

One of the critical factors about DeFi is governance and voting, which makes the system community based and Bifrost with BiFi token this area is settled.

BiFi Token is the governance token for BiFi and with this token on the platform, holers can:

- Vote on proposals to improve on BiFi service

- Invest and generate passive income

- Use as insurance

- It used as a transaction fee when using multichain services.

- Trade with it on exchanges.

As BiFi is built on the multichain middleware platform Bifrost, it needs to lock-up and pay a certain amount of BFC (Bifrost token) when using Bifrost. Read about Bifrost

Four Ways To Earn BIFI Token

- Purchase BIFI tokens on exchanges.

- Earn BIFI tokens by liquidity pool mining (BFC/ETH) and staking (BFC) on BiFi.

- Earn BIFI tokens as a Service Incentive, an incentive to BiFi service users who lend or borrow assets on BiFi.

- Social engagement by starting with Telegram (Closing February 14th)

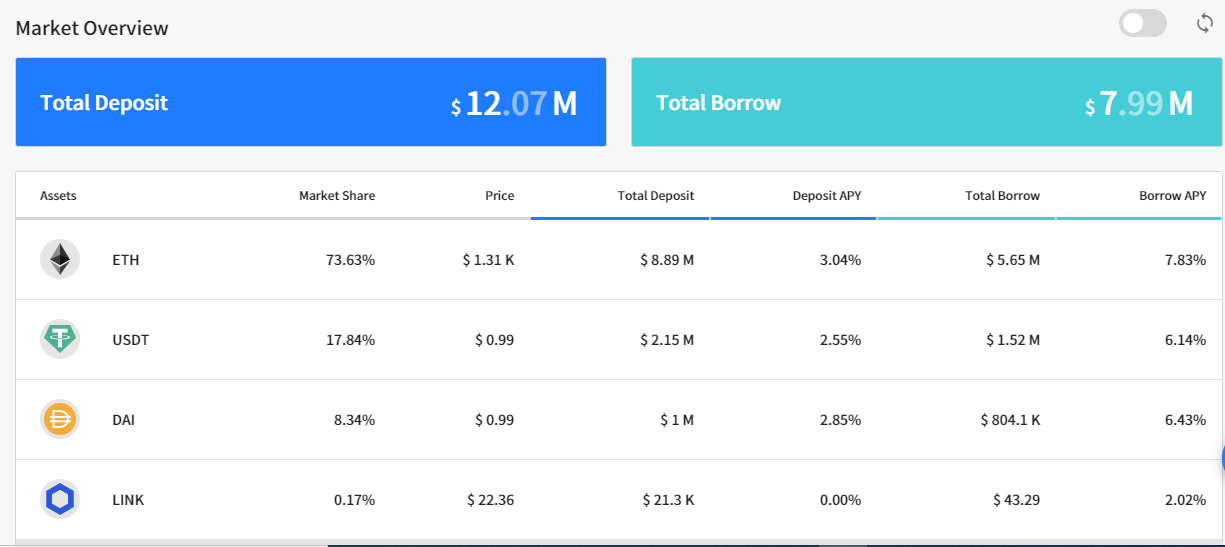

BiFi App has Four Assets at the moment which is: ETH, DAI, USDT, and LINK with over 12Million dollar deposit into its market and 7 million dollars borrowed. Also, total BFT deposited on the staking platform is over 160 million dollars with 3.81% APY.

For More Info:

https://bifi.finance/

https://thebifrost.io/

Telegram Bot | Medium | Twitter | YouTube | WhitePaper