Bitcoin is Now Looking More Like a Defensive Asset than Gold and Silver

As I am writing this, Bitcoin is at eighty two thousand dollars. You have to go back almost a year to April 2025 to be able to see prices at these levels. In the last three months Bitcoin has been very boring, basically going nowhere.

I feel like it is consolidating and the speculative money left Bitcoin and altcoins and if you look at gold and silver they now trade like crypto. Today gold dropped about ten percent in about one hour. When was the last time this happened?

Gold and silver are supposed to be safe and relatively boring assets that people buy to protect their assets from inflation. These are slow moving assets which are not supposed to have Bitcoin like movements of ten percent in one day.

But we see that Gold and Silver are going parabolic and are displaying this blow off top like behavior. Does this mean that a top is close for gold and silver? I would not say so, as markets can remain irrational longer than you can remain solvent.

This has become a very dangerous territory where gold and silver can drop by around fifty percent or more during a correction in this speculative bubble. If you want capital preservation against inflation these assets are no longer that.

In fact Bitcoin is likely to be a safer asset at these prices and offer a better protection against dollar devaluation. I have actually picked up some Bitcoin today. I think that accumulating at these prices is a good idea long term.

Sure we can see Bitcoin dropp to mid seventy thousands and I will be accumulating. I still think Bitcoin is going to outperform most traditional assets and gold and silver long term.

Hive has also dropped today to some key levels, we are sitting at eight cents which is pretty much the lowest level since that giant drop in October. It sure looks like we might still fill that gap down before things turn around.

This is not the time to sell, but the time to accumulate. I remember when I bought physical silver trust PSLV and gold miners ETF in 2022 it was trading around the same price for a while, then it dropped to a paper loss of over fifty percent. I held on to both, it was pretty much dead money for about two years before it started moving slowly in 2024 and accelerated last year.

I sold the last of the PSLV this year, but before the most recent pump. I am happy with the profit on that investment. Most of the proceeds are sitting in money market fund, but I plan to slowly deploy those into Bitcoin and Solana ETF.

I also have Etherium, but that is my largest position and I feel that I have enough of it in my portfolio already. I want to own more Bitcoin and Solana as a bet on an Etherium alternative in case not all financial services are going to be built on Etherium.

For some applications Solana fits better as it is faster. Where performance matters Solana could be a better fit as in high frequency trading applications. I also think that major crypto chains are the more likely winners.

Sure there will be big winners in smaller altcoins, but how much confidence do I have in my ability to pick those? Not very much, so I am sticking to the coins that have major ETFs already which is pretty much: Bitcoin, Etherium, Solana and XRP.

I don't own the XRP, but that is OK, can't have everything. My small bets are ONDO, AERO, NEAR, SPS and Hive. SPS took a bit of a dive today as well. It was holding $0.008 and above for a while and today it went down to $0.0077

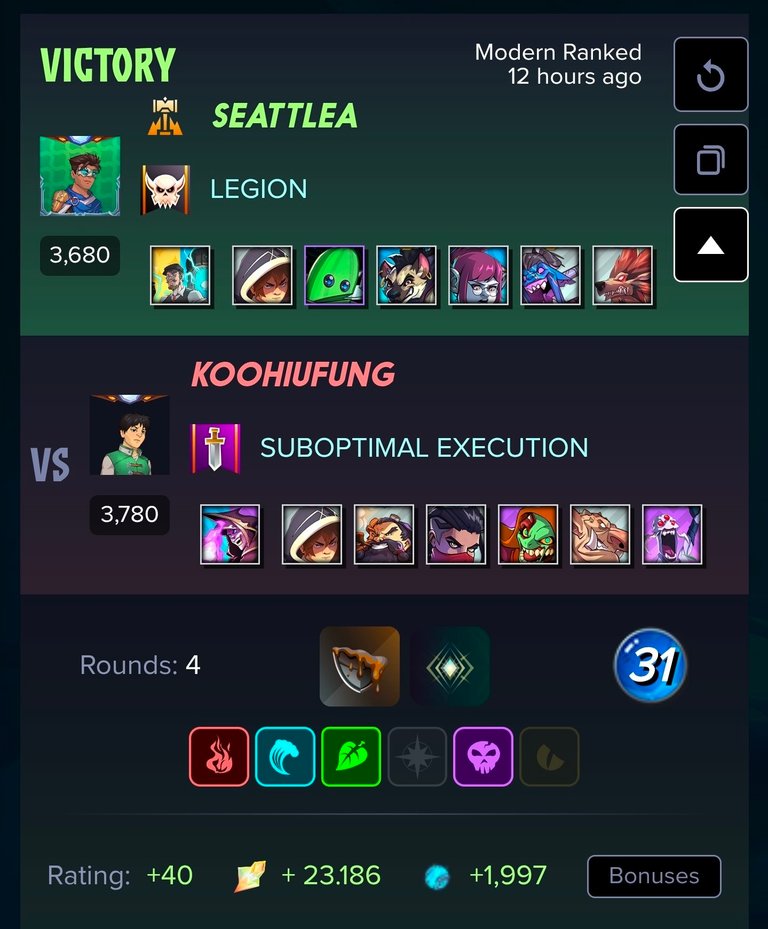

My experiment with focusing more on Modern league in Splinterlands this season is going well so far. I am holding on to the first place in Modern league Silver leader board.

With just over a day left in the season I have pulled away from the rest and seems like I will be safe for the first place. There is competition for the second as I see pladozero and bunanags jokey for a position.

The SPS earnings in the modern Diamond One ranked play are pretty good, averaging around twenty SPS tokens per win:

I think right now is a great time to accumulate SPS tokens by playing in Modern league. Wild league has a lot tougher competition and the SPS token earnings are significantly lower at around eight SPS per win in Champion.

As far as Actifit and steps I did pretty good today and also managed to fit in a forty minute HIIT workout into my day.

This report was published via Actifit app (Android | iOS). Check out the original version here on actifit.io

I don't think this is the end for gold and silver either. I think they still have a lot of room to run. With this latest dip I have been trying to decide if I want to buy more BTC or ETH. I don't own any SOL. BNB is always attractive too.

I think at some point the real flood of retail money will come into crypto market through the mainstream investment vehicles that are available everywhere and that is ETFs. Are you aware of any BNB ETF funds?

No, I don't do much with ETF's though because I prefer to just hold the assets. I hope you are right though!

It would benefit you either way, because when the money comes the coins that have ETFs will pump. There are multiple advantages to holding actual coins one is self custody, two is ability to trade when the mainstream markets are closed and three you are not paying the management fee or the premiums that exist at times...

Congrats on providing Proof of Activity via your Actifit report!

You have been rewarded 468.505 AFIT tokens for your effort in reaching 13594 activity, as well as your user rank and report quality!

You also received a 2.48% upvote via @actifit account.

Rewards Details

To improve your user rank, delegate more, pile up more AFIT and AFITX tokens, and post more.

To improve your post score, get to the max activity count, work on improving your post content, improve your user rank, engage with the community to get more upvotes and quality comments.

Chat with us on discord | Visit our website

Follow us on Twitter | Join us on Telegram

Download on playstore | Download on app store

Knowledge base:

FAQs | Whitepaper

How to signup | Maximize your rewards

Complete Actifit Tutorial

Support our efforts below by voting for:

Sounds like you picked a good day to pick up some Bitcoin my friend!👍😀

Seems like all the markets are acting a little bit odd..... you're right I haven't seen gold silver move this much in one day ever before!!

And look at that 21% dump in Silver today:

If you bought Silver at the top price yesterday you are already down 25%+ that is just wild for something like Silver...

You are so correct my friend, silver is not supposed to react this way......

Thankfully all of our silver was purchased well below $20 an ounce!😇

I just picked up some cheep Bitcoin as well this morning!!👍😀